Brookville Redevelopment Commission

In 2012, the Town of Brookville created the Brookville Redevelopment Commission (BRC). It consists of five voting members and one non-voting member (School board) that serve one-year terms (Jan-Dec) that are all residents of the Town of Brookville. They are appointed annually by the Town Council and Town Council President.

These members should come from all segments of the community like property owners, merchants, businesses, landscape architects, civil engineers or related specialties. They should have a willingness to participate actively in commission efforts and shall have expertise and interest in sustainability and development of the Town.

2024 Brookville Redevelopment Commission members are:

Todd Thackery, President tthackery@shp.com

Rita Seig, Vice-President ritaseig@seigsurveying.com

John Rudisell, Secretary rudygotcha@gmail.com

Rebecca Hamilton rebeccahamilton333@gmail.com

John Estridge Jestridge@yahoo.com

Kevin Kaiser, Franklin County School Board kkaiser@fccsc.k12.in.us

Click here to read the original ordinances.

What does a Redevelopment Commission do?

The Commission will investigate, study and survey areas needing redevelopment, promote the use of land in the best interest of the Town, and replan and dispose of areas that need redevelopment that best serves the social and economic interests of the Town. They may also purchase, use, sell or clear land. They can maintain structures for redevelopment purposes or contract for local public improvement. They can also accept loans or grants from other governmental entities and other organizations and provide financial assistance to individuals and other groups.

When does the BRC meet?

Third Monday of each month at 6:00pm in the Town Municipal Building, 1020 Franklin Ave.

What is the Municipal Riverfront Development District/Project?

Ordinance 2017-2 created a Riverfront Development Project Area for the purpose of issuing three-way alcoholic beverage licenses. Although Indiana does limit the number of licenses in other areas, they do not limit the quantity of alcoholic beverage licenses in Riverfront districts which may lead to increased economic development. Check out documents 1-11 in the library on this page to get more information on the alcohol permit process.

What is the Brookville Facade grant?

The Brookville Redevelopment Commission (BRC) offers grants to commercial/industrial businesses and property owners within the Town of Brookville for a variety of purposes. The BRC’s main objectives for the façade grant program are to encourage visual improvements, historic preservation and economic investment. Eligible projects include general building/property improvements, for example: exterior painting, or repairs, signage, awnings, and landscaping. Projects may include parking area surfacing/resurfacing as long as this work is not the only work performed within the project. Projects that encompass capital investments above and beyond general building/property improvements are encouraged and preferred. (All improvements must comply with the Town of Brookville zoning and building regulations and Historic Preservation Guidelines and be approved by the Brookville Redevelopment Commission)

Brookville Redevelopment Commission (BRC) will reimburse 50% of project costs, up to a maximum of $10,000 per pre-approved project. BRC reserves the right to award grants in amounts less than 50% of project costs for any reason, including availability of funds, aesthetic value of the project, or any other reason at their sole discretion.

The application and more details about the program can be obtained at the Town Municipal Building or by downloading the application here Brookville Facade Grant Application.

There is a $100.00 fee for the application.

What is the Brookville/Franklin County Opportunity Zone?

The Tax Cuts and Jobs Act of 2017 (P.L. 115-97) allowed governors to nominate certain census tracts as Opportunity Zones, subject to approval from the U.S. Department of Treasury. Up to 25% of a state’s low-income census tracts were eligible for designation, which permitted Indiana to nominate up to 156 census tracts as Opportunity Zones. States were required to submit their lists of Opportunity Zones to the U.S. Department of Treasury no later than April 20.

Opportunity Zones provide federal capital gains tax advantages for investments made in these areas. This designation is intended to attract capital investment into areas that are economically distressed.

To be eligible as an Opportunity Zone, census tracts had to qualify as “low-income”. To do so, the census tract must have met one of the following requirements:

- The tract has a poverty rate of at least 20%; OR

- (A) For a census tract in a metropolitan area, the tract’s median family income does not exceed 80% of the greater of: the metropolitan area median family income or the statewide median family income; or (B) For a census tract in a non-metropolitan area, the tract does not exceed 80% of the statewide median family income.

However, if the census tract is located within a high migration rural county, the tract qualified as low-income if it did not exceed 85% (as opposed to 80%) of statewide median family income. A “high migration rural county” is any rural county that, during the 20-year period ending with the year in which the most recent census was conducted, has a net outmigration of inhabitants from the county of at least 10% of the county population at the beginning of such period.

Looking for more information about Opportunity Zones? The U.S. Department of the Treasury and the Economic Innovation Group have provided more information here. The text of the legislation creating the Opportunity Zone program can be accessed here.

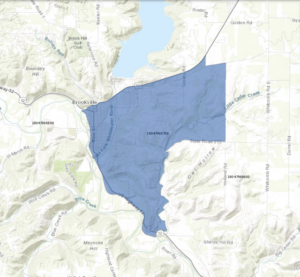

Opportunity Zone map for Brookville/Franklin County.

What is a Tax Increment Financing (TIF)?

Indiana is among many states that allow the use of tax increment financing (TIF) to generate funding for local public infrastructure that is intended to promote private investment. Information about TIF districts is now collected through the TIF Management application on Gateway on an annual basis, with 2014 as the first full reporting year.

Redevelopment in Indiana through the use of TIF districts is primarily governed by Indiana Code 36-7-14.

Click here for BRC resolutions on the TIF district: Resolution 2013-1, Resolution 2017-2, Resolution 2018-2, Resolution 2019-2, Resolution 2019-5.